Understanding the limited recourse borrowing arrangement

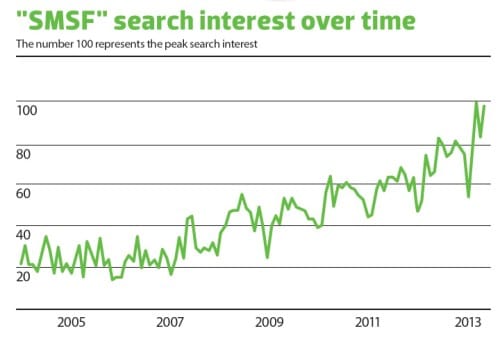

When taking out a self managed super fund (SMSF) loan in order to invest, you will need to create a specific borrowing arrangement. This is known as a limited recourse borrowing arrangement (LRBA). In order to ensure your structure meets LRBA guidelines, you must meet certain guidelines. First, the borrowing must be used to obtain […]

Read More